Consignment VS Direct sales

At GabyLuxxy, we understand the importance of flexibility when it comes to selling your luxury items. That’s why we offer two distinct options: Consignment and Direct Sale. In this guide, we’ll walk you through the differences between these two choices, explain when we might not be able to purchase items directly, and shed light on the impact of taxes on your sale price.

Consignment:

1. Ownership Retention: When you choose consignment, you retain ownership of your luxury items throughout the selling process. We act as your trusted partner, displaying and marketing your items to potential buyers.

2. Extended Exposure: Consignment offers your luxury items an extended period of exposure in our store or online platform, increasing the chances of finding the right buyer at the right price.

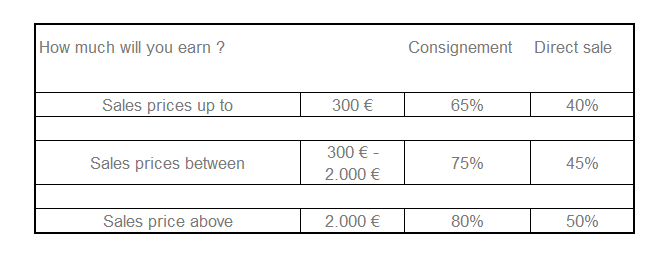

3. Final Sale Price: You’ll receive the final sale price, minus our agreed-upon consignment fee, once your item is sold. This fee covers our efforts in marketing, displaying, and facilitating the sale.

Direct Sale:

1. Immediate Payment: Opting for a direct sale means you receive immediate payment for your luxury item. This can be a convenient option if you need funds quickly.

2. Simplicity: Direct sales offer a straightforward transaction process, eliminating the need for ongoing involvement in the sale.

3. Tax Considerations: Please note that direct sales may result in a reduced final payout compared to consignment due to tax considerations. We must account for taxes on our end, which can affect the final amount you receive.

When Direct Sales May Not Be Possible:

While we strive to accommodate direct sales whenever asked by the seller, there are situations where we may be unable to purchase items directly:

- Market Demand: If there is low demand for the specific item or style you’re selling, we may recommend consignment as a more viable option.

- Condition: The condition of your luxury item is a crucial factor. If it doesn’t meet our quality standards, we may not be able to make a direct purchase.

Understanding the Impact of Taxes:

Taxes are an essential consideration in secondhand luxury sale. When you choose a direct sale, taxes come into play, which can affect your final payout. We are legally obligated to account for and remit the necessary taxes on the sale. This is why the final amount you receive in a direct sale may be lower than the sale price.

In summary, the choice between consignment and direct sale depends on your preferences and circumstances. While direct sales offer immediate payment, consignment provides extended exposure, a higher payout and ownership retention. It’s essential to be aware of the tax implications associated with direct sales and the factors that may affect our ability to purchase items directly.

For a personalized consultation and to discuss the best option for your luxury items, please don’t hesitate to contact our team at info@en.gabyluxxy.com. We’re here to assist you every step of the way.